Diese Seite möchte Cookies verwenden, um Ihr Benutzererlebnis zu optimieren

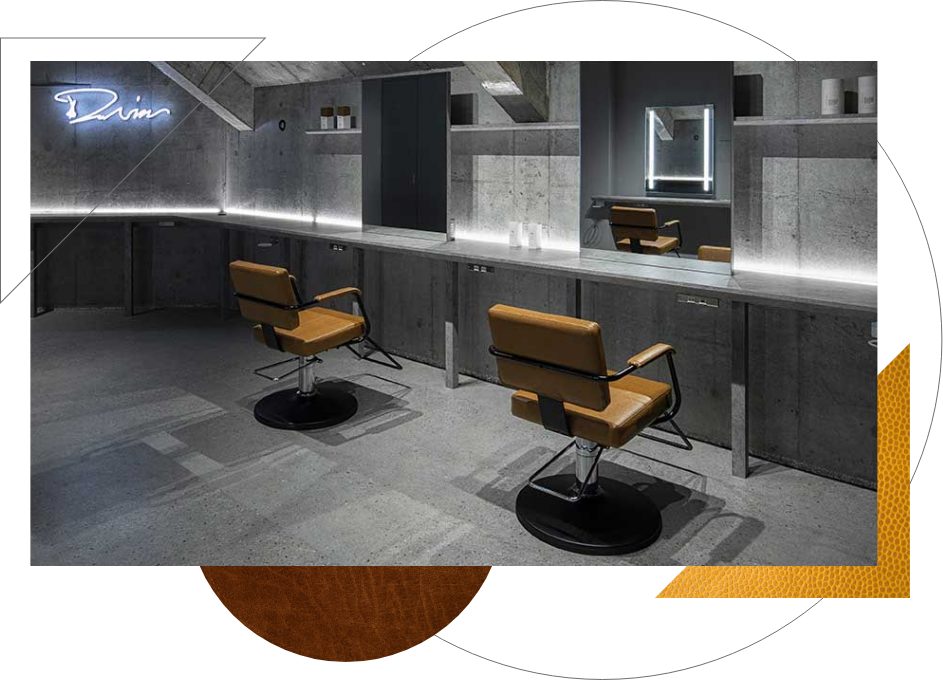

Top reasons to lease your salon equipment

page-content.finance.section-4.item-1.copy

page-content.finance.section-4.item-2.copy

page-content.finance.section-5.heading

There's never been a better time to upgrade your equipment with our new 0% Finance Leasing scheme.

Enquire now for 0% finance over 2 years with NO deposit and transform your salon or barbershop with our world-class equipment!

Simply click ENQUIRE below and our National Sales Manager will call you back to discuss your needs, or click APPLY NOW to apply online.